Back in 2002, a monumental art heist took place at Amsterdam’s Van Gogh Museum. Two priceless paintings were stolen by master thieves in a daring, almost cinematic operation. The paintings were recovered from the Camorra organized crime group in Naples in 2016 by Italian law enforcement.

Despite the near impossibility of selling the paintings on the open market, such priceless works of art are invaluable to figures high up in the shadowy world of organized crime. They simply do not lose value and are therefore used as an underworld currency, an easy form of collateral or an easy way to transfer vast wealth internationally. Art theft is a horribly sordid matter, but it is a testament to the value of art as an investment.

S&P 500 and Recession

Knowing how to invest in the leadup to or during a recession can be tricky. Despite the sweeping shorthand of economists, every recession is unique. There have been nine recessions since the establishment of the S&P 500 in 1957. Unfortunately, when it comes to investing, the past is no indicator of future results. The index has responded differently to each recession, and analyzing Art Market vs Stock Market correlation is not always easy. Every sector responds differently to each recession as well. For example, a Homebuilding company may have gained consistently over the last five recessions. However, the 2007 recession was sparked by a housing bust, laying waste to the otherwise robust homebuilding sector. Over the past five recessions, the S&P 500 has declined an average of 4.4%.

The worst impact on the stock market can come three to six months prior to a recession as investors anticipate the recession and price it in. This means it can be hard to time the impact that a recession will have on stocks in a given sector. To be fair, in the last five recessions, the stocks of about a dozen S&P listed companies both beat the market and posted average gains. Consumer staples tend to be safe bets, with Walmart shares rising an average of 42.4% during the last five recessions. However, If you want to do better than ‘safe’, the art market could be what you’re looking for.

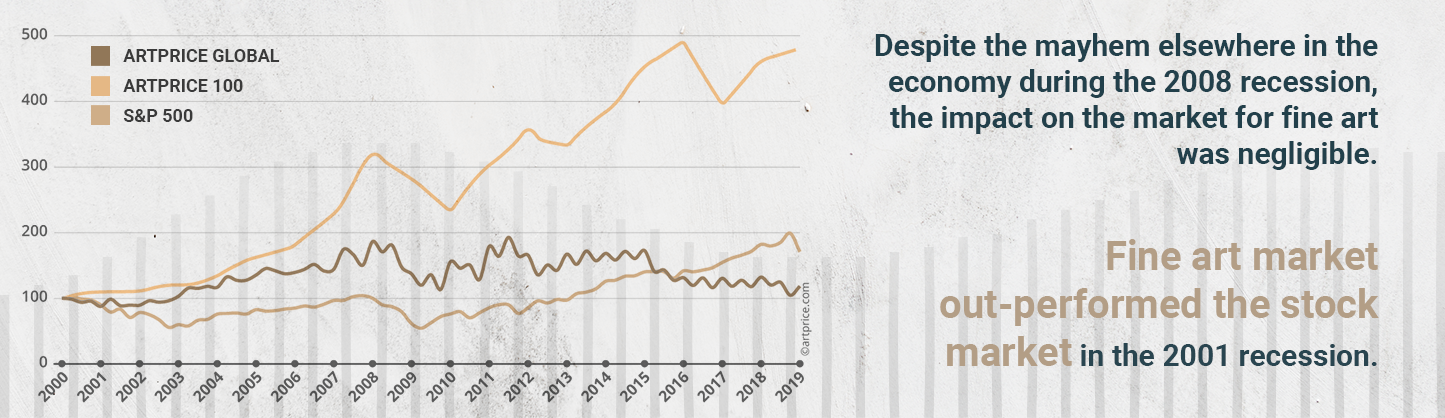

Art Market out-performance

Despite the mayhem elsewhere during the 2008 recession, the impact on the market for fine art was negligible. The fine art market also out-performed

Fine art as an investment is tracked in indices such as Sotheby’s Mei-Moses index. No index is

This can lead to selection bias, but frankly, the S&P 500 is hardly innocent of similar issues itself.

The performance of Mei-Moses tends to rival that of stocks, which are generally the best performing asset. Art indices can outperform stocks at times, especially in recessionary periods. In fact, recessions can push the art market up, as money runs to a relatively safe haven. Compared to stocks, fine art as an investment is distinguished by its low volatility. It may not be the most liquid asset in the world, but art offers a great option for diversifying your portfolio; especially if you have an eye toward a coming recession.

Art Market, Long-term investment opportunity

We never know exactly when the next recession will hit. We can only be dead sure that it is coming, sooner or later. When it does come, it will offer an excellent opportunity to invest for the long term. Buying and holding for the long term has a far greater success rate than jumping in and out of stocks at a quick pace.

Art is a perfect example of long-term investment. Rarity is the mark of value in the art world. If you are lucky enough to snag an early work by an up-and-coming artist, it could reap serious rewards five to ten years down the line.

Playing the art market, oddly enough, is more of an art than a science. You will have the best success if you listen to your taste and sentiment rather than approaching it strictly as an investment opportunity. As with your portfolio on whole, diversifying your art investments is a wise idea. Recently, a whole profession of art investment advisors has sprung up to help investors to do this.

However you choose to get into art, you will have diversified into an excellent, low-volatility, recession-beating, long-term investment opportunity.

Buying art online can be a daunting experience. Be sure to check our brief recap of the five costly mistakes people often make when buying artworks online!